Cost inflation index mainly used for calculation of long term capital gain (LTCG).

Current Cost Inflation Index Table

| Financial Year | CII for the Year |

|---|---|

| 2001-02 : Base Year | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

| 2021-22 | 317 |

| 2022-23 | 331 |

| 2023-24 | 348 |

| 2024-25 | 363 |

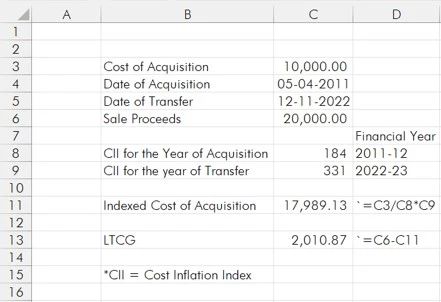

Indexed Cost of Acquisition Formula

Indexed Cost of Acquisition = CII for the year of Transfer * Cost of Acquisition / CII for the First Year or Financial Year 2001-02, Whichever is later

Frequently Asked Questions

In which year Cost Inflation Index was introduced in India?

In the year 1981, the Cost Inflation Index was introduced and later Base year changed to F.Y. 2001-02 (FMV on 1st April, 2001) and CBDT notifies the Cost Inflation Index every year in the official gazette.

What is the Cost Inflation Index for the Financial Year 2023-24 (Assessment Year 2024-25)?

The cost inflation index for the Financial Year 2023-24 is 348.

What is Excel Formula for Cost Inflation Index Calcualtion for LTCG?

Excel Formula =C3/C8*C9

Where,

C3= Cost of Acquisition

C8= CII for the Year of Acquisition

C9= CII for the year of Transfer

What is Full Form of CII?

CII Stand For “Cost Inflation Index” which is used in Calculation of LTCG in Income Tax.

What is the Cost Inflation Index for the Financial Year 2024-25 (Assessment Year 2025-26)?

The cost inflation index for the Financial Year 2024-25 is 363.

Excel Sheet for CII Calculation

Sources

Kindly Refer to Privacy Policy & Complete Terms of Use and Disclaimer.